When it comes to shipping goods internationally, proper documentation is crucial to ensure smooth customs clearance and compliance with regulations. One important aspect of this process is the inclusion of tax information, including your Employer Identification Number (EIN). If you’re using Ordoro, you can easily add your EIN for certain carriers, making your shipping process smoother and keeping everything above board.

Topics

- What is an EIN tax number and why do I need it?

- How do I add my tax information for an international shipment?

- Can I create a preset to recall the tax information on future shipments?

What is an EIN tax number and why do I need it?

A Tax EIN, or Employer Identification Number, is a unique nine-digit number assigned by the IRS to businesses for tax purposes. Including your EIN helps customs authorities verify the legitimacy of your business, ensuring that all shipments comply with regulations. Having your EIN on shipping documents can expedite the customs clearance process, reducing the likelihood of delays.

How do I add my EIN tax information for an international UPS shipment?

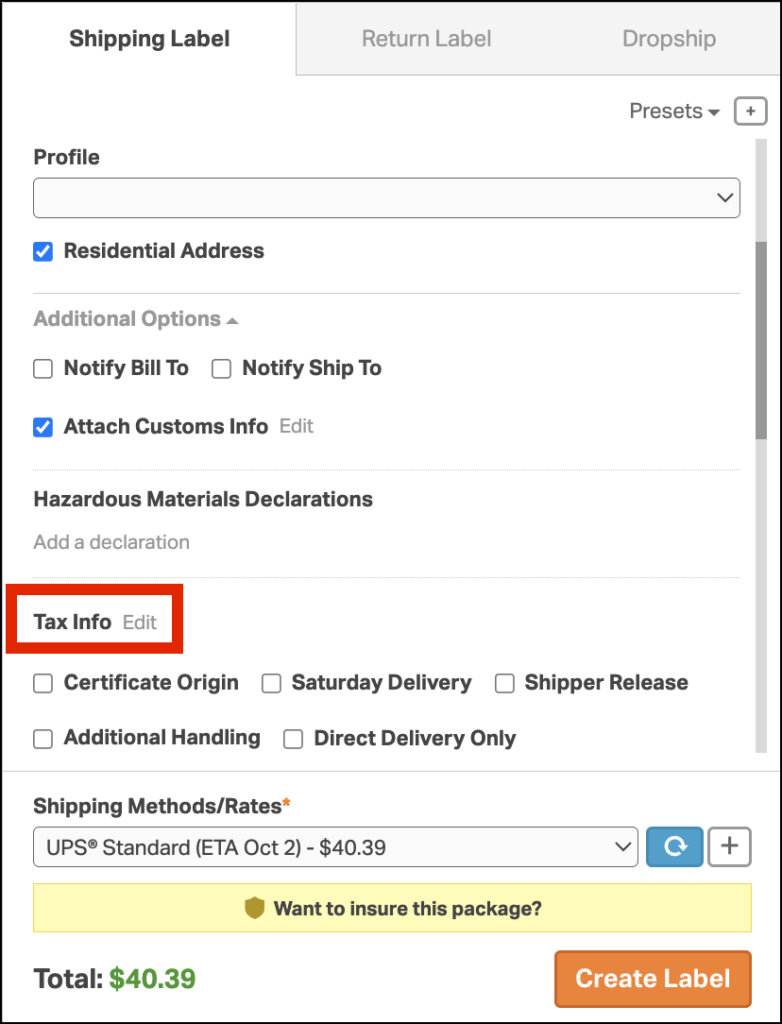

- From the Orders tab, select the international order.

- Select UPS as your carrier.

- Click Additional Details to expand the section.

- Under Tax Info, click on Edit.

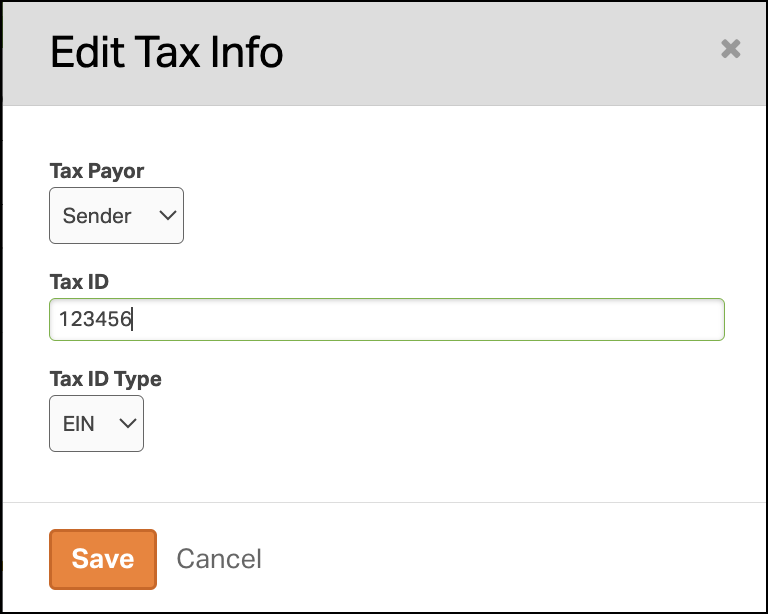

- In the Edit Tax Info modal:

- Choose either Sender or Receiver from the Tax Payor dropdown.

- Enter your Tax ID.

- Select the Tax ID Type from the dropdown.

- Click Save.

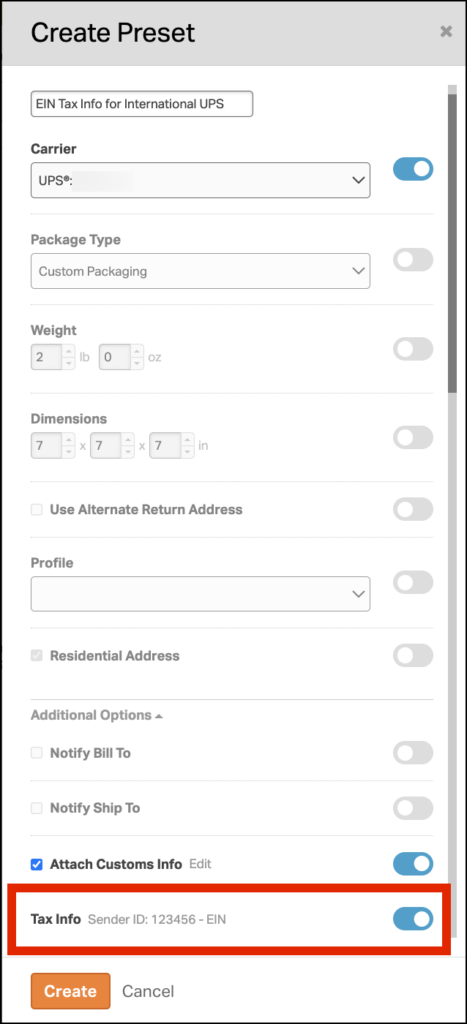

Can I create a preset to recall the tax information on future shipments?

Yes, Ordoro allows you to save Tax Info within a preset in the Label Panel. This feature enables you to apply the same tax information on future shipments without re-entering the details for each one.

Refer to this help article for details on creating and managing shipping presets.