Welcome to Ordoro’s comprehensive guide on calculating weighted average unit costs for your products! If you’re looking to gain a clear understanding of how to determine the weighted average unit cost for the items in your inventory, you’re in the right place!

Whether you’re a business owner, a retailer, or just someone interested in inventory management, this article will break down the process in a simple and easy-to-follow manner. Join us as we delve into the world of inventory costing methods and learn how Ordoro can help streamline your operations and ensure accurate cost calculations.

Topics

- What is Weighted Average Unit Cost?

- Enable automatic Weighted Average Unit Cost calculation

- How Ordoro calculates the Weighted Average Unit Cost

- Example calculation

What is Weighted Average Unit Cost?

Weighted Average Unit Cost is an inventory valuation method that accounts for both the cost and quantity of items on hand. Instead of using a simple average, WAUC gives more weight to items based on how many are in stock at a given cost.

Enable automatic Weighted Average Unit Cost calculation

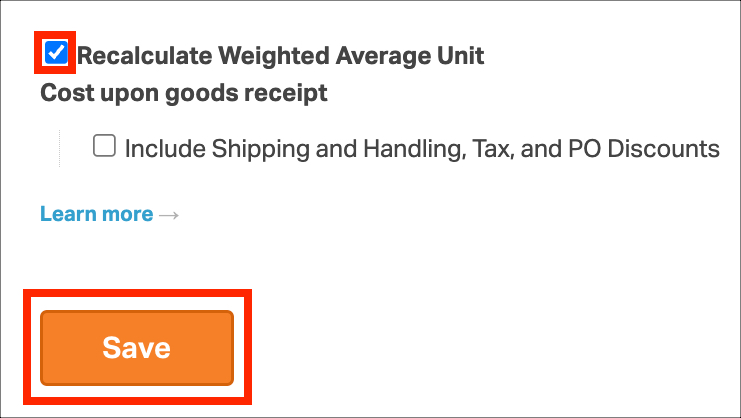

To turn on this feature:

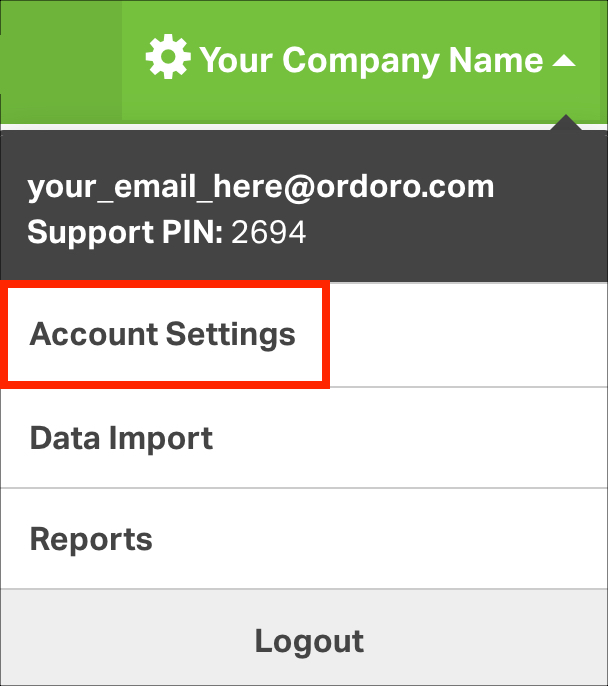

- Click on your Company Name -> Account Settings.

- Scroll down to Recalculate Weighted Average Unit Cost upon goods receipt.

- Check the box and click Save.

You can also select Include Shipping and Handling, Tax, and PO Discounts in the calculations.

Notes on fee and discount allocation:

- PO-level fees and discounts are split evenly across all items in the PO, not weighted by line cost.

- Example: A $1000 shipping fee on a PO with 2 lines (each with 100 units) will increase the unit costs equally, regardless of item price.

- Line-level discounts are divided by item quantity.

- Example: A $10 discount on a line of 10 units reduces each item’s cost by $1.

- Partial receipts are proportionally considered.

- Example: Receiving 3 items out of 20 means 15% of PO-level discounts/fees are applied.

- Over-received items are not included in WAUC calculations.

How Ordoro calculates the Weighted Average Unit Cost

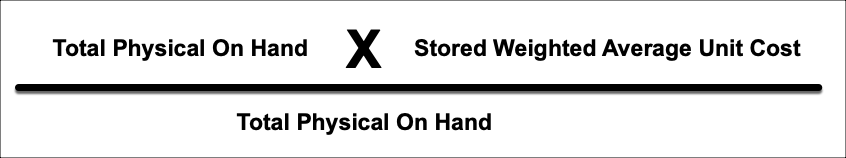

When enabled, Ordoro recalculates the WAUC whenever you receive products through a Purchase Order. Here’s how:

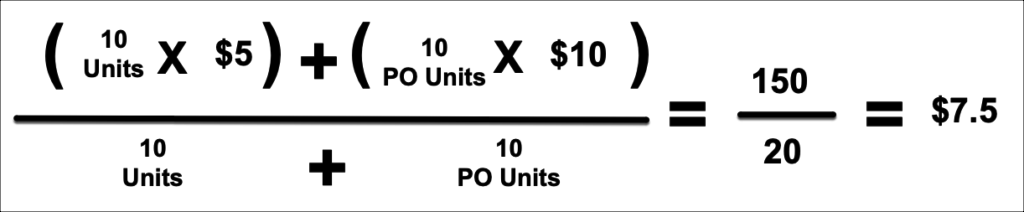

- Multiply the existing Physical on Hand by its current WAUC.

- Divide by the new total Physical on Hand.

If inventory reaches zero or goes negative, the WAUC resets based on the Supplier Unit Cost from the PO.

Note: Ordoro stores the WAUC up to 10 decimal places, but this level of precision isn’t displayed in the app.

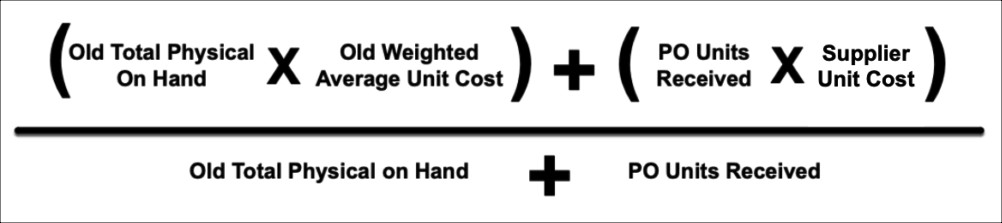

Upon receiving a product on a Purchase Order, Ordoro recalculates the item’s Weighted Average Unit Cost using the following calculation:

Example calculation

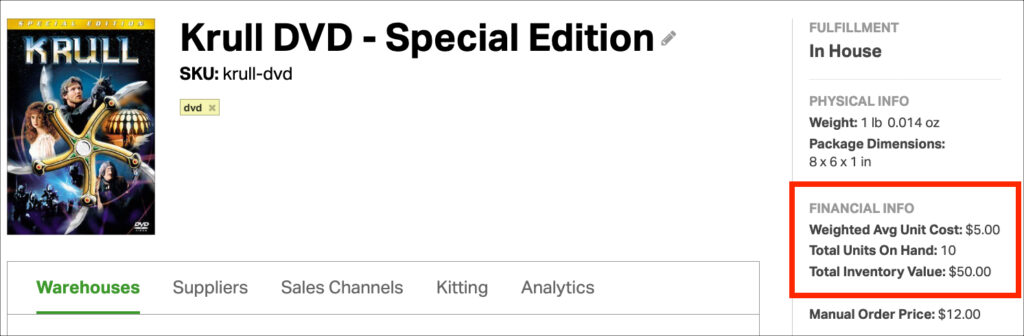

Let’s walk through an example using a Krull DVD:

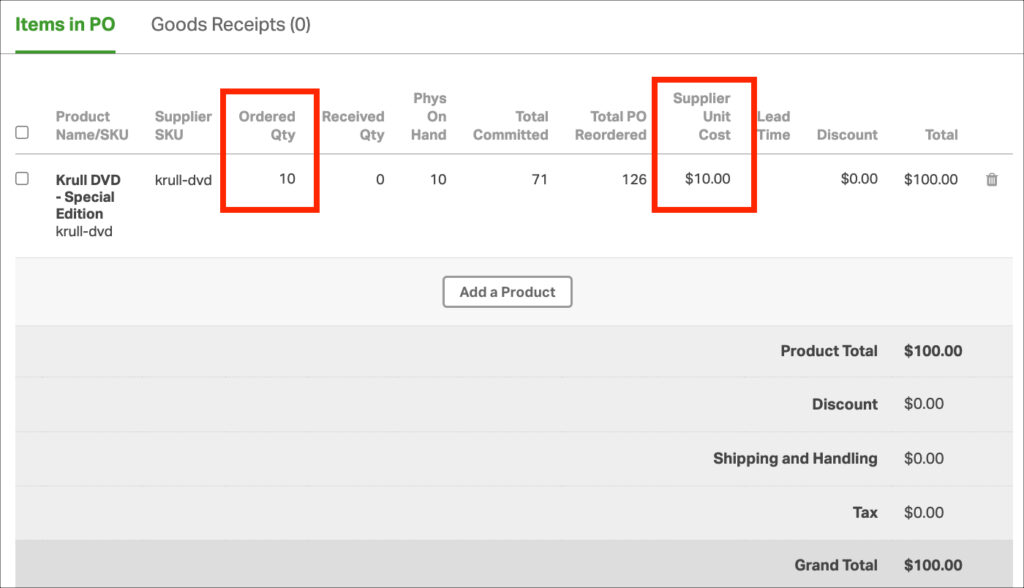

- Current inventory: 10 units

- Current WAUC: $5.00

- New Purchase Order: 10 units at $10.00 each

Upon receiving the PO, Ordoro uses the WAUC formula:

((10 units x $5.00) + (10 units x $10.00)) ÷ (10 + 10)

= ($50 + $100) ÷ 20

= $150 ÷ 20

= $7.50

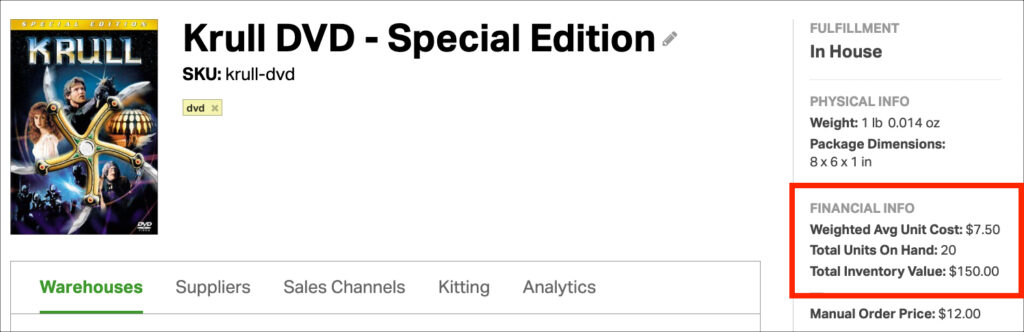

Click the GIF below to watch the calculation in action.

After the calculation, the product’s Weighted Average Unit Cost is displayed as $7.50.